-40%

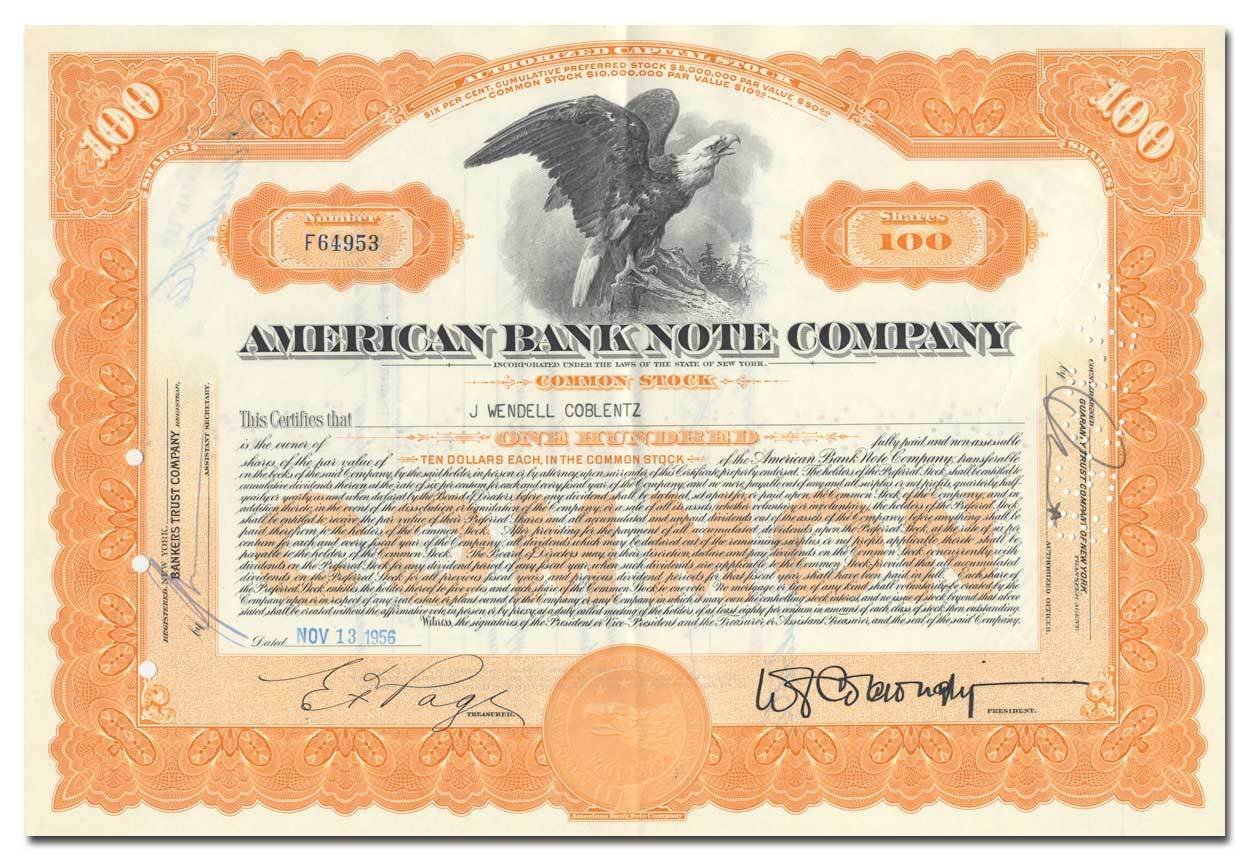

American Bank Note Company Stock Certificate

$ 2.64

- Description

- Size Guide

Description

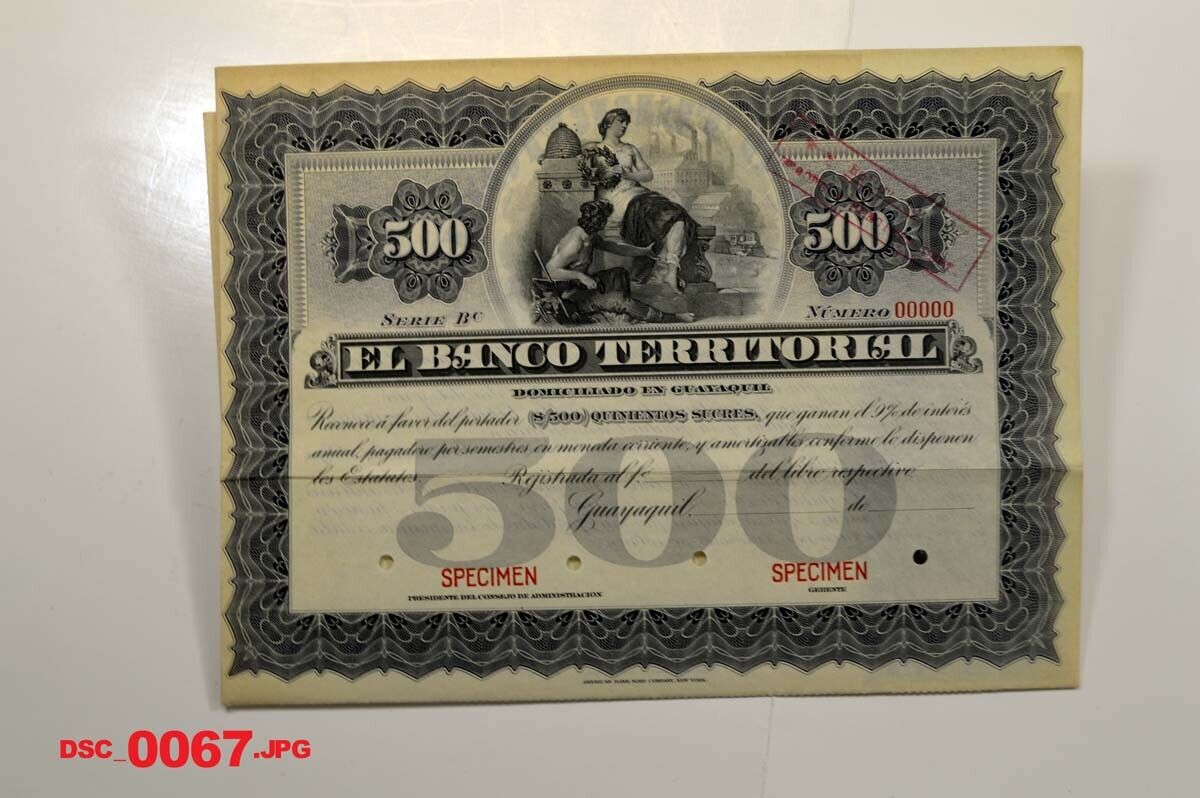

Product DetailsIntricately engraved antique stock certificate from the American Bank Note Company dating back to the 1950's. This document, which carries the printed signatures of the company President and Treasurer, was printed by the American Bank Note Company - of course - and measures approximately 12 1/4" (w) by 8 1/2" (h).

The certificate vignette features a stately eagle perched on a crag.

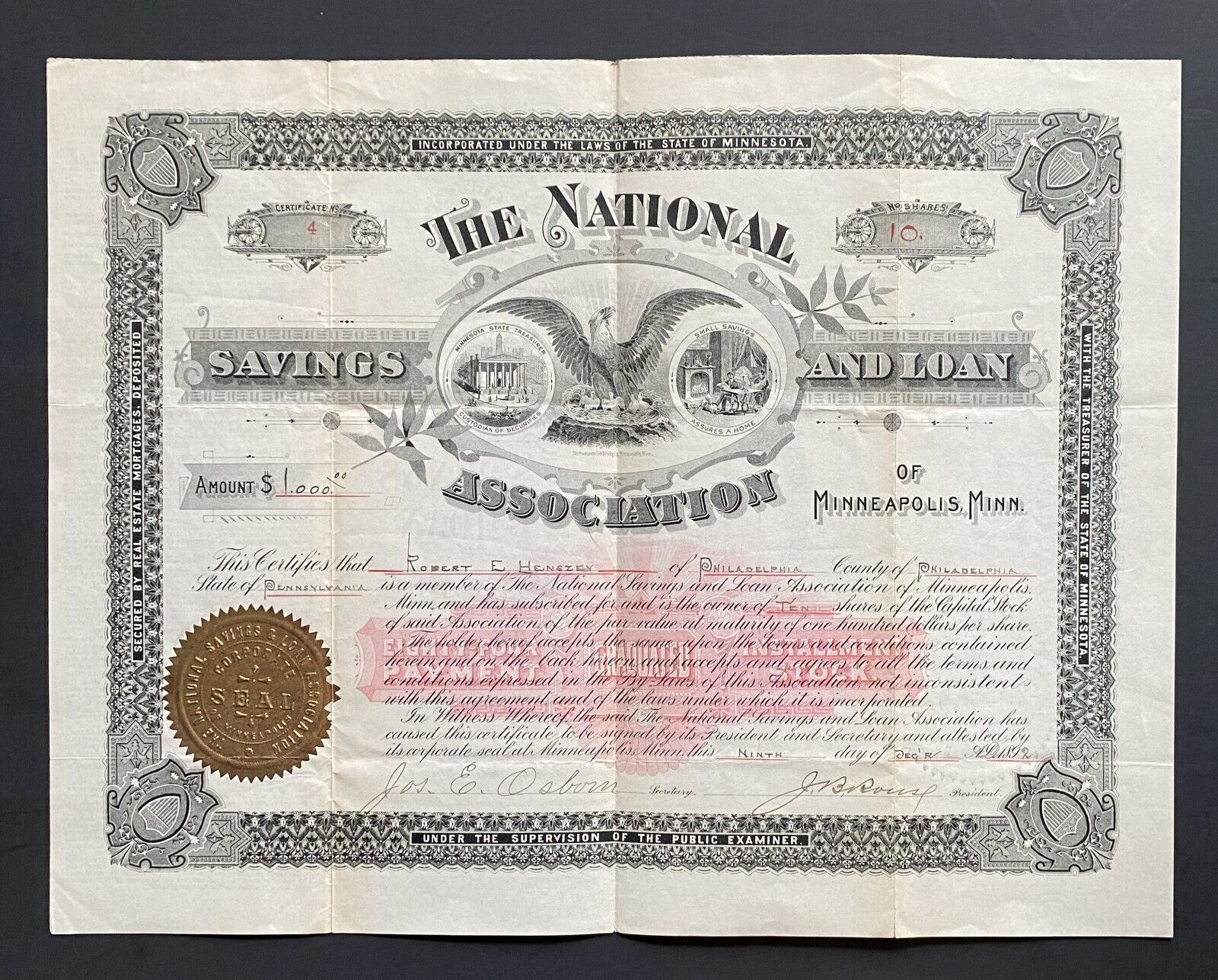

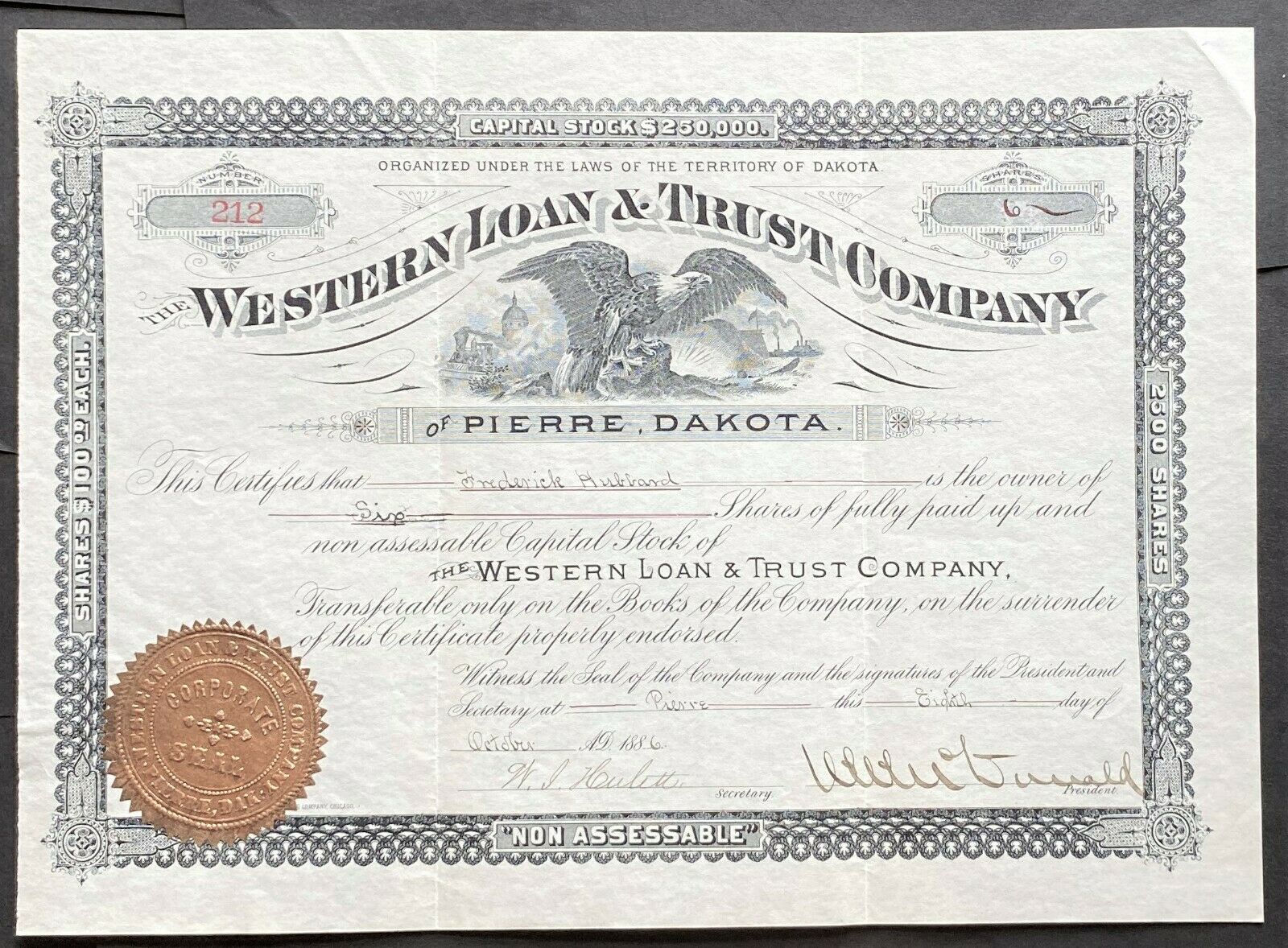

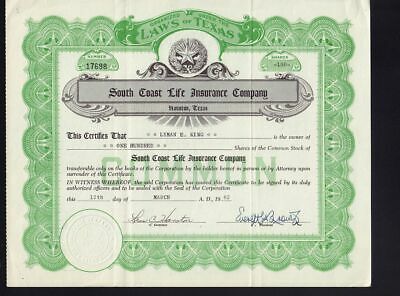

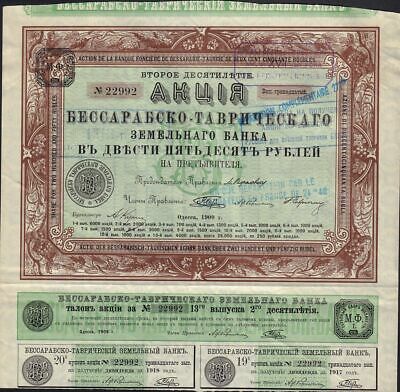

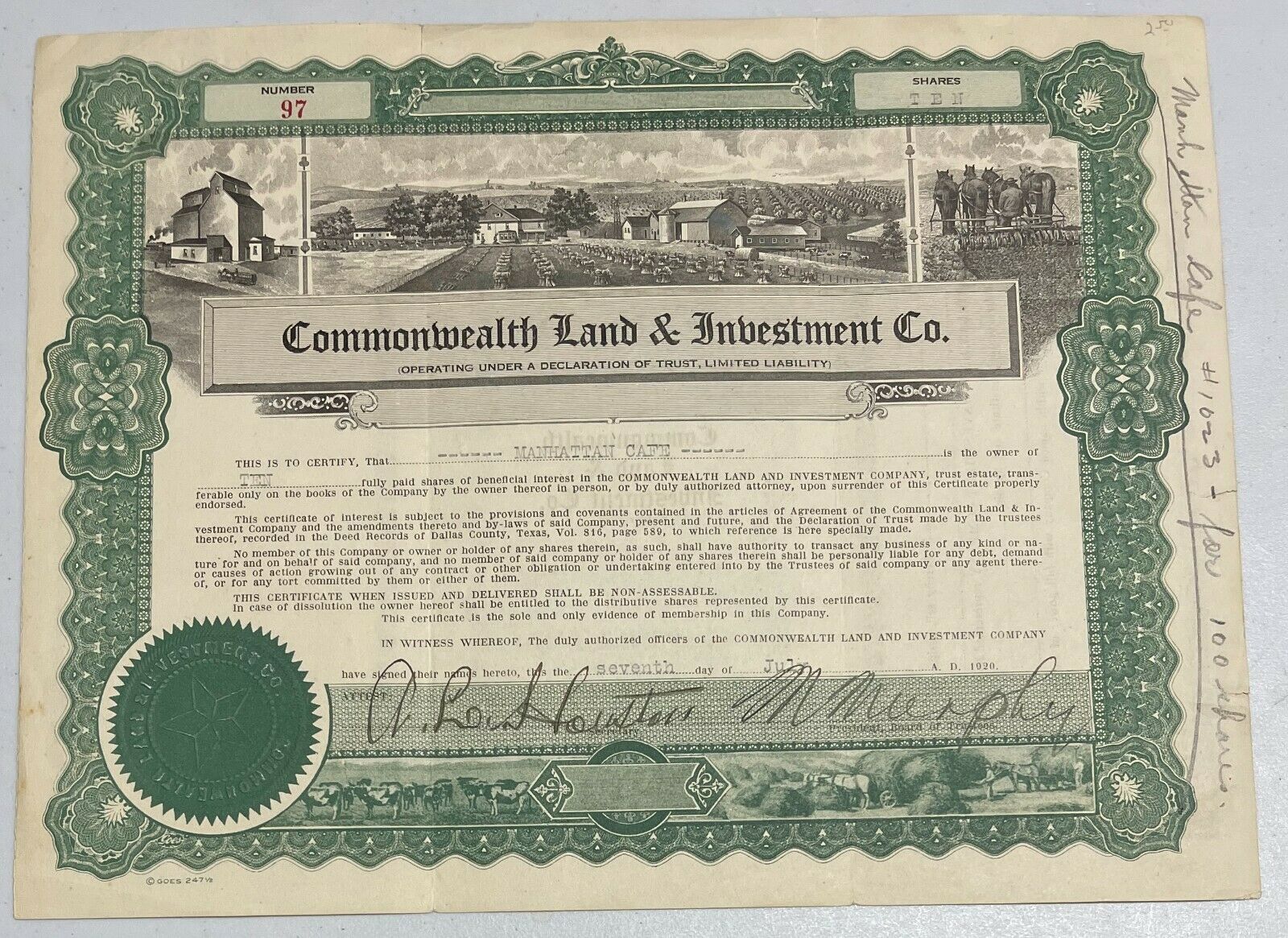

Images

The images presented are representative of the piece(s) you will receive. When representative images are presented for one of our offerings, you will receive a certificate in similar condition as the one pictured; however dating, denomination, certificate number and issuance details may vary.

Historical Context

The huge was formed from an association of seven competing companies in 1858 (Rawdon, Wright, Hatch & Edson; Toppan, Carpenter & Co; Danforth, Perkins & Co; Bald, Cousland & Co; Jocelyn, Draper, Welsh & Co; Wellstood, Hay & Whiting; John E. Gavit). In 1879, it merged with the National Bank Note Company and the Continental Bank Note Company. In 1911, it merged with the United Bank Note Company. These acquisitions and mergers continued as the ABN became the largest producer of financial paper in the world.

Because it employed the finest engravers, the images that ABNCo offered were of the highest and most durable quality. It created thousands of classic images after 1858, but continued to use images from all its ancestral companies. That is why you will find identical vignettes on many diffferent certificates with different engraving company imprints.

Unfortunately for the company, paper stock and bond certificates were eventually supplanted by electronic trading. By the 1990s, all but a tiny percentage of security ownership had become a matter of electronic record. By 1999, the amount of global security and bank note printing had dropped so precipitously that the company ultimately had to declare Chapter 11 bankruptcy.